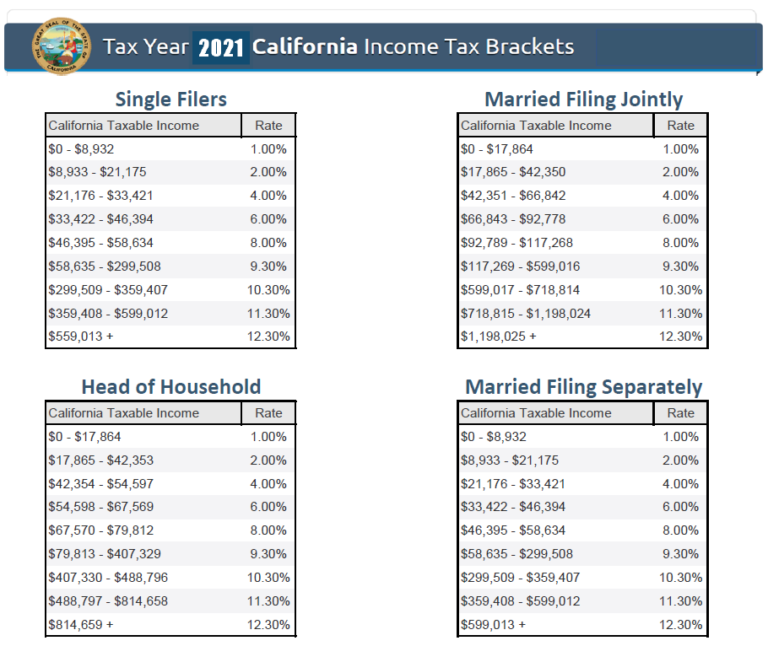

California State Income Tax 2025. Welcome to the income tax calculator suite. The california income tax has ten tax brackets, with a maximum marginal income tax of 13.30% as of 2025.

What is the deadline for filing california state taxes in 2025? Quickly figure your 2025 tax by entering your filing status and income.

For the 2025 tax year, dependents can claim either $1,250 or their earned income plus $400, whichever is greater.

how do i cancel my california estimated tax payments?, 2% on taxable income between $8,545 and $20,255. The california income tax has ten tax brackets, with a maximum marginal income tax of 13.30% as of 2025.

What Is The California State Tax Rate For 2025 Federal, Detailed california state income tax rates and brackets are. For 2025, the limit is the greater.

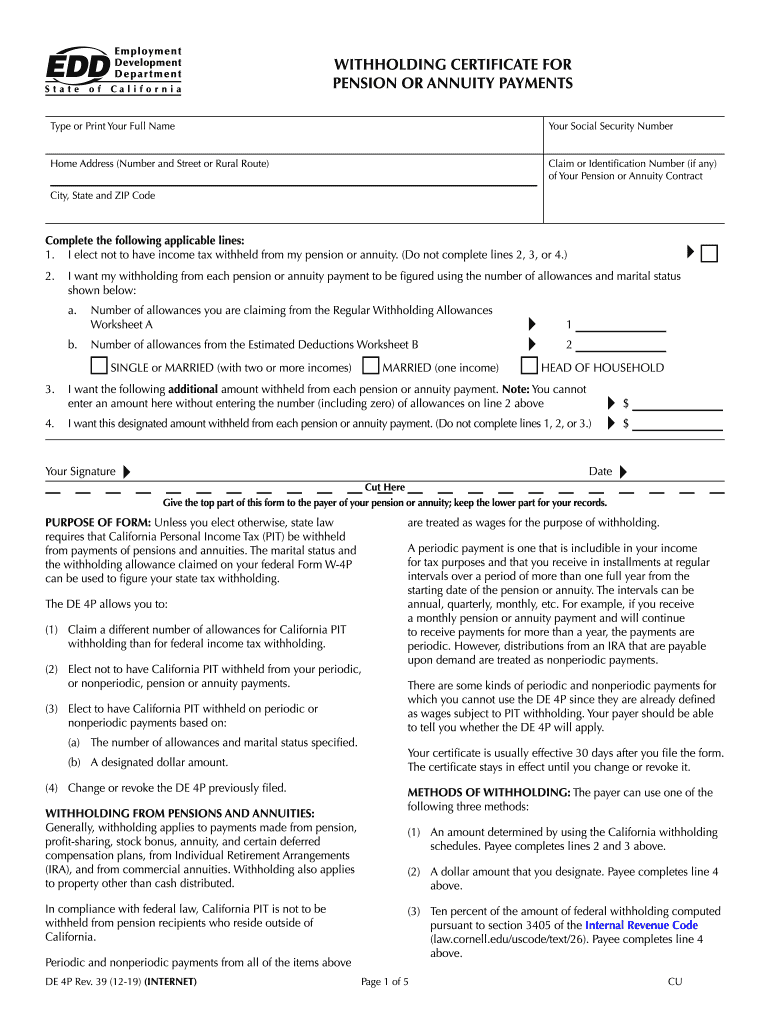

20192024 Form CA EDD DE 4P Fill Online, Printable, Fillable, Blank, The annual salary calculator is updated with the latest income tax rates in california for 2025 and is a great calculator for working out your income tax and salary after. Income tax calculators by state.

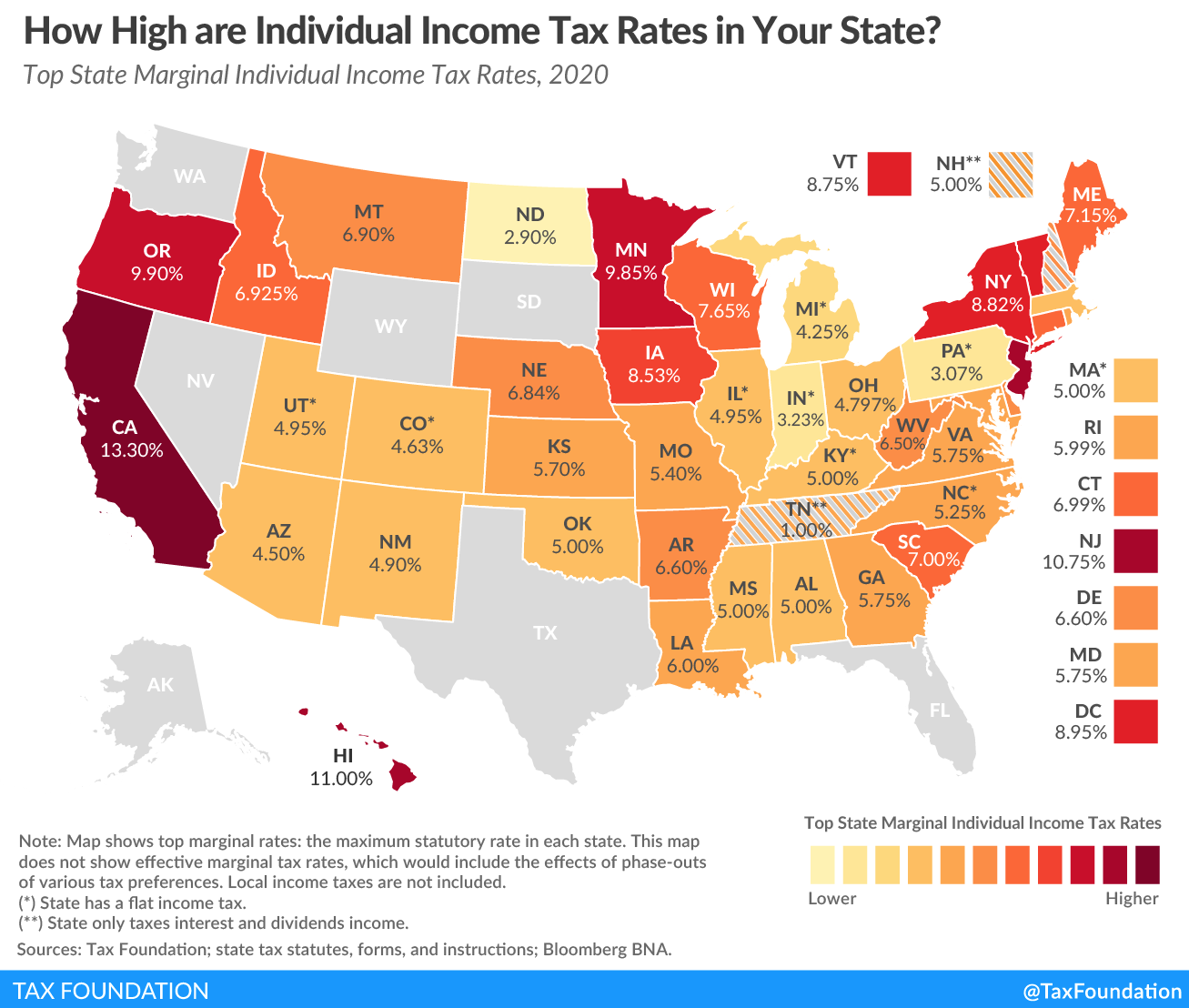

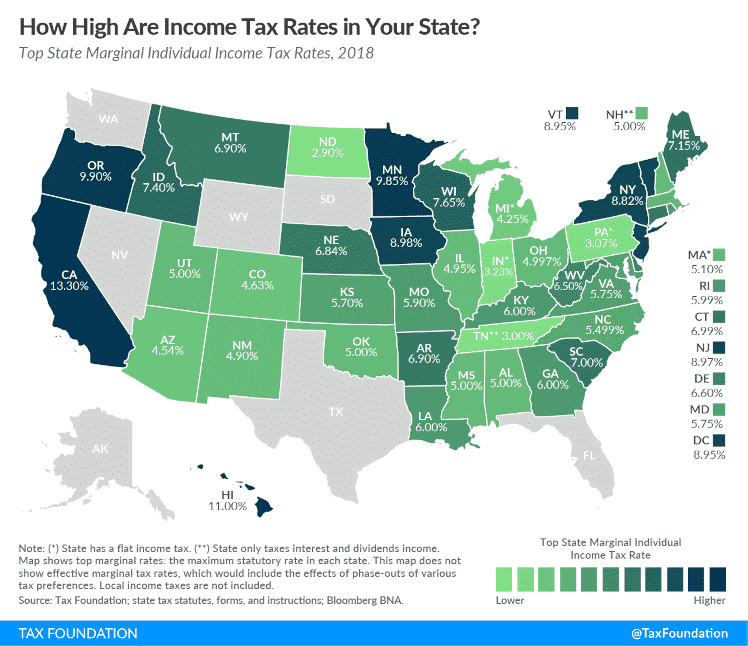

Ranking Of State Tax Rates INCOBEMAN, California withholding schedules for 2025. What is the deadline for filing california state taxes in 2025?

State Corporate Tax Rates and Key Findings What You Need to, You can quickly estimate your california state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way. State income taxes are levied by the state government on income earned within that state.

미국 주별 개인 소득세 비교 Landing Help 뉴저지 주 캠든/벌링턴 카운티 지역, But california has a graduated tax rate, which. This page has the latest california brackets and tax rates, plus a california income tax calculator.

미국 각 주(State)별 개인 소득세(Individual Tax), Who must make estimated tax payments. The plan to drop the rate from 5.49% to 5.39%,.

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, California withholding schedules for 2025. The california franchise tax board (ftb), california department of tax and fee administration (cdtfa) and california employment development.

California W4 2025 Form Printable Forms Free Online, 2% on taxable income between $8,545 and $20,255. The tax tables below include the tax rates,.

2025 Iowa Tax Brackets New 2026 Iowa Flat Tax, 0 Retirement Tax, You can quickly estimate your california state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way. The california income tax has ten tax brackets, with a maximum marginal income tax of 13.30% as of 2025.